Remember the early days? You bought some Bitcoin on one exchange, maybe some Ethereum on another. Tracking was easy. But now? Your crypto life is a chaotic mix of exchange accounts, a hardware wallet, a few software wallets, and maybe even some staked assets in a DeFi protocol you barely remember. Trying to figure out your actual net worth feels like solving a puzzle with missing pieces.

If you’re still wrestling with a clunky spreadsheet, manually updating prices and transaction histories, you’re not just wasting time—you’re flying blind. In the volatile world of digital assets, having a clear, real-time, and accurate view of your holdings isn’t a luxury; it’s essential for survival and success.

This is where a dedicated crypto portfolio tracker becomes your most valuable tool. Finding the best crypto portfolio tracker means transforming that data chaos into actionable clarity. This guide, meticulously researched by the experts at Scentia Research Group, will break down the top platforms for 2025, so you can stop managing spreadsheets and start managing your wealth.

![]()

1. CoinStats: Best for All-in-One DeFi & NFT Tracking

![]()

CoinStats has evolved from a simple tracker into a comprehensive platform for the modern crypto investor. Its strength lies in its incredible breadth of integrations, making it the top choice for anyone heavily involved in DeFi and NFTs.

Key Features:

- Connects to over 300 exchanges and wallets.

- Industry-leading DeFi tracking to monitor staking, lending, and liquidity pools.

- Integrated NFT gallery that tracks floor prices.

- Built-in crypto news aggregator and alerts.

Pros & Cons:

- Pros: Unmatched number of integrations, excellent DeFi features, powerful mobile app.

- Cons: The most advanced features are locked behind a significant subscription fee.

Pricing: Robust free version available. Premium plans start around $13.99/month.

Who It’s For: The power user who has assets scattered across CEX, DEX, DeFi, and NFTs and wants one single dashboard to rule them all.

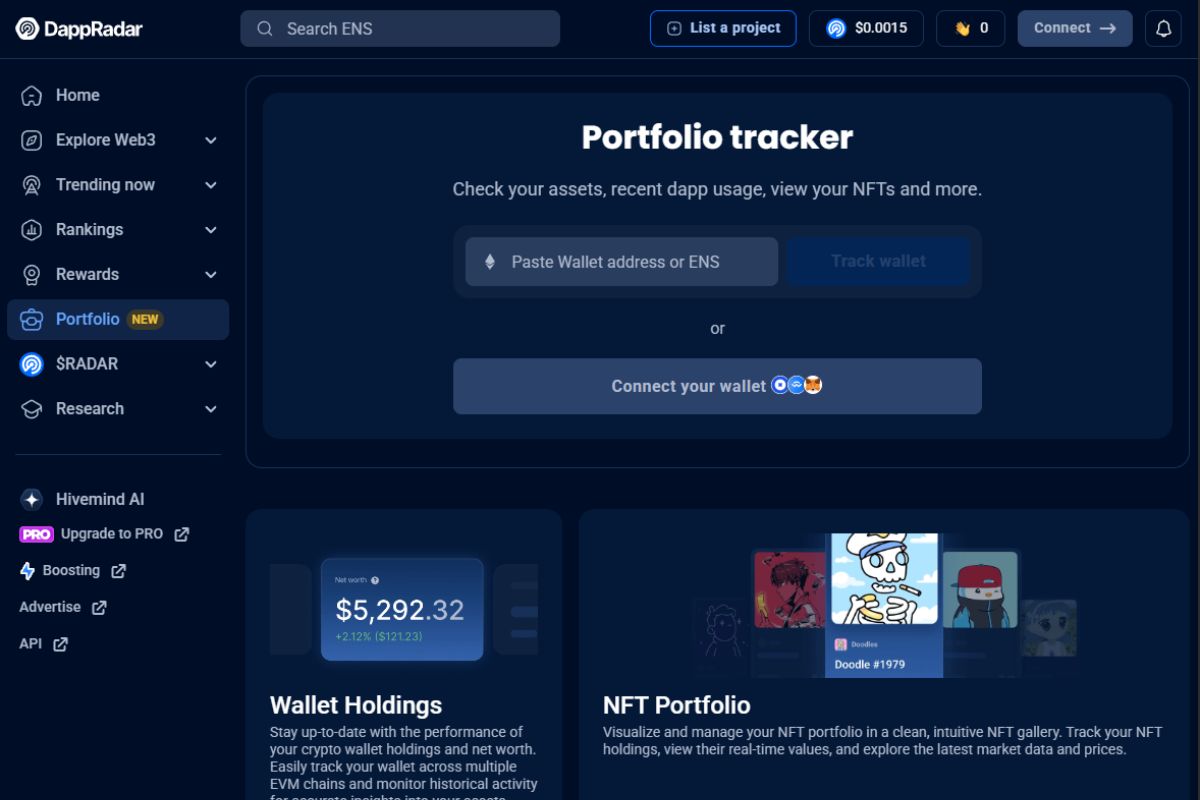

2. The DappRadar Portfolio: Best for Web3 Natives

While others started with exchanges, DappRadar built its reputation on the world of decentralized applications. Their portfolio tracker is a natural extension of this, offering a wallet-first, Web3-native experience that is second to none.

Key Features:

- Simply enter your ENS name or wallet address to get started.

- Real-time tracking of tokens, DeFi positions, and NFTs.

- Provides historical wallet balance and P&L analysis.

- Directly integrated with DappRadar’s extensive dApp ranking data.

Pros & Cons:

- Pros: Excellent for a quick, privacy-focused overview; strong Web3 integration; completely free.

- Cons: Lacks manual transaction inputs and CEX integrations via API.

Pricing: Free.

Who It’s For: The Web3 enthusiast or “DeFi degen” who primarily interacts with decentralized protocols and wants a quick, accurate snapshot of their on-chain net worth.

3. Delta: Best for a Sleek Mobile Experience

Delta has long been a favorite in the community for one primary reason: its user experience is flawless. It offers a beautiful, intuitive interface, especially on mobile, that makes tracking your portfolio a pleasure, not a chore.

Key Features:

- Supports stocks and ETFs alongside crypto for a complete financial picture.

- Intelligent alerts for significant price changes or portfolio updates.

- Clean and highly customizable portfolio analytics.

- NFT explorer that connects to top marketplaces.

Pros & Cons:

- Pros: Best-in-class UI/UX, multi-asset tracking, powerful free version.

- Cons: Some newer, more obscure DeFi protocol integrations can be slow to arrive.

Pricing: Free version is very capable. Pro plans with unlimited connections start at around $50-60 per year.

Who It’s For: The design-conscious investor who wants a beautiful and powerful tool to track both their crypto and traditional finance assets on the go.

4. CoinGecko: Best Free Crypto Portfolio Tracker

![]()

CoinGecko is already a go-to resource for crypto price data, and its free, integrated portfolio tracker is one of the most popular in the space. While it relies on manual entry, its simplicity and integration with CoinGecko’s massive database make it a powerful starting point.

Key Features:

- Leverages CoinGecko’s comprehensive database of over 10,000 assets.

- Create multiple portfolios (e.g., “Long-Term,” “Trading”).

- Simple and clean interface for tracking P&L.

- Completely free to use.

Pros & Cons:

- Pros: 100% free, backed by reliable data, easy to use.

- Cons: No automatic syncing via API or wallet addresses; all transactions must be added manually.

Pricing: Free.

Who It’s For: The beginner or budget-conscious investor who wants a no-frills, reliable way to manually track their holdings.

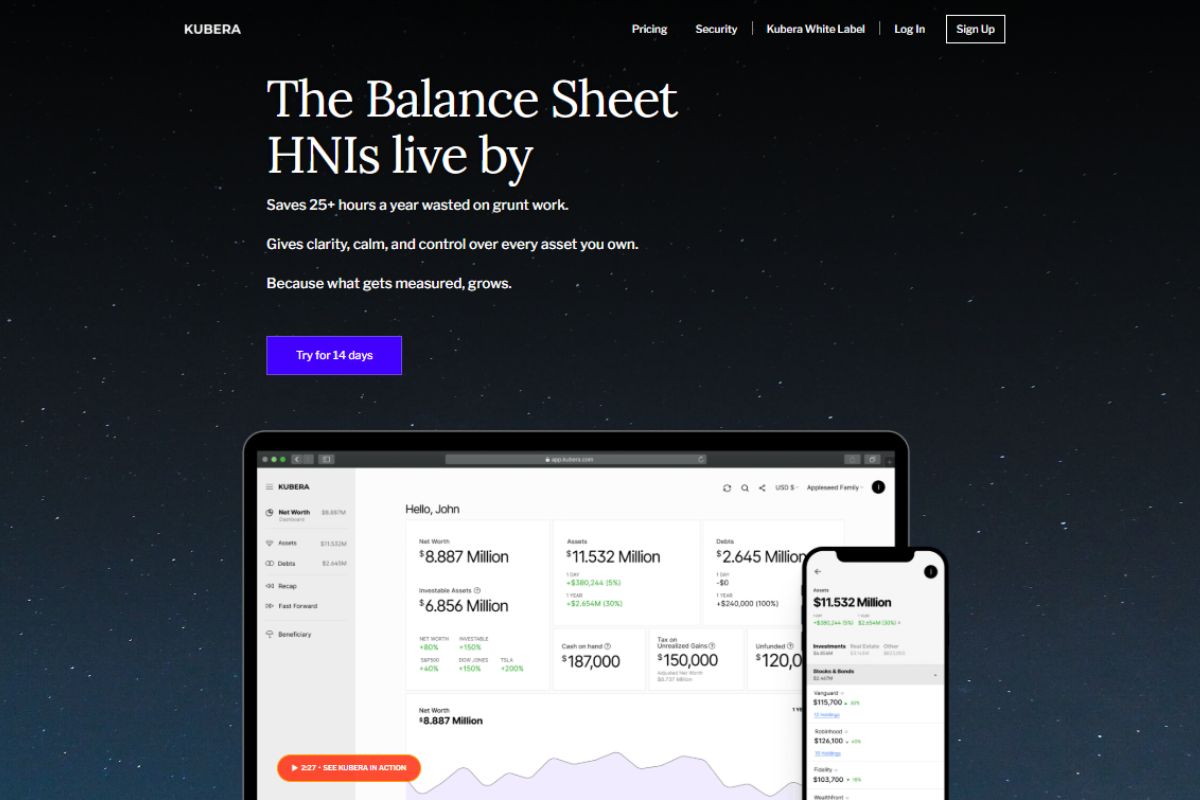

5. Kubera: Best for Total Wealth Management

Kubera isn’t just a crypto tracker; it’s a life tracker. It’s designed for the high-net-worth individual who wants to see their crypto alongside their real estate, stock portfolio, car value, and domain names. It’s the ultimate big-picture tool.

Key Features:

- Tracks cryptocurrencies, stocks, fiat, precious metals, real estate, and more.

- Clean, minimalist, spreadsheet-like interface.

- Focuses on privacy and does not sell user data.

- “Dead Man’s Switch” feature to securely pass on portfolio information to a beneficiary.

Pros & Cons:

- Pros: The most comprehensive “all-in-one” wealth tracker available; excellent security and privacy focus.

- Cons: It’s a premium product with no free tier; crypto analytics are less granular than dedicated tools.

Pricing: Subscription-based, typically around $150/year.

Who It’s For: The serious investor who sees crypto as one part of a larger, diversified wealth portfolio and values privacy above all else. [External link: Learn more about Kubera’s features].

6. Zapper: Best for a DeFi-First View

Zapper lives and breathes DeFi. If your portfolio consists mainly of assets staked in liquidity pools, yield farms, and lending protocols across multiple chains, Zapper is your command center. It excels at untangling the complexities of your DeFi positions.

Key Features:

- Instant dashboard view by connecting your wallet.

- Aggregates DeFi positions from dozens of protocols across multiple EVM chains.

- “Zap” feature allows you to enter and exit complex DeFi positions in a single transaction.

- Focus on on-chain data and composability.

Pros & Cons:

- Pros: Unrivaled view of DeFi holdings, innovative “Zap” functionality, community-focused.

- Cons: Primarily focused on DeFi, so CEX tracking and manual inputs are not its priority.

Pricing: Free.

Who It’s For: The active DeFi user who needs a tool built specifically to navigate and manage the complexities of decentralized finance.

7. Accointing by Glassnode: Best for Tax-Conscious Investors

Acquired by the acclaimed on-chain analytics firm Glassnode, Accointing is laser-focused on one of the biggest headaches for crypto investors: taxes. It combines excellent portfolio tracking with one of the most robust crypto tax reporting engines on the market.

Key Features:

- Generates detailed, audit-proof tax reports for multiple countries.

- Tax-loss harvesting tool to identify opportunities to optimize your tax position.

- Deep integration with exchanges and wallets to ensure accurate data import.

- On-chain tracking powered by Glassnode’s data expertise.

Pros & Cons:

- Pros: Top-tier tax reporting features, backed by the credibility of Glassnode, user-friendly.

- Cons: The core value is in the paid tax plans; free tracking is more limited than some competitors.

Pricing: Tracking is free. Tax report generation is a one-off purchase, typically starting around $79 per tax year.

Who It’s For: Any investor in a jurisdiction with crypto taxes who wants to stay compliant and potentially save money with smart tax strategies. [Internal link: Read our guide on crypto tax fundamentals].

Beyond Tracking: Leveraging Your Data with Advanced Analytics

Choosing the best crypto portfolio tracker is a critical first step. It gives you the “what”—a clear picture of your assets. But the most successful investors also have the “why” and the “what’s next.”

This is where a portfolio tracker’s job ends and the work of deep-dive analysis begins. Your tracker might show your ETH balance increasing, but it won’t tell you that whale accumulation on-chain is surging, or that network-to-value ratios are indicating it’s undervalued relative to its historical performance.

From Raw Data to Actionable Insights with Scentia Research Group

At Scentia Research Group, we bridge the gap between your portfolio data and strategic decision-making. While your new tracker organizes your assets, our institutional-grade research provides the forward-looking intelligence to grow them.

Our clients use the very tools listed above to manage their holdings. They rely on our analysis to understand the market dynamics that will impact those holdings.

- See a new altcoin trending in your tracker? Our comprehensive tokenomics reviews and fundamental analysis can help you vet its long-term viability before you invest.

- Wondering whether to HODL or take profits on your Bitcoin? Our reports on on-chain metrics, derivatives market data, and macroeconomic trends provide the context you need to make a confident decision.

- Confused by a new DeFi narrative? We break down complex trends into clear, actionable insights, separating the hype from the genuine innovation.

A great tracker gives you control. Our research gives you an edge.

Frequently Asked Questions (FAQ)

1. Are crypto portfolio trackers safe? Reputable trackers use read-only API keys, meaning they can see your balances but cannot initiate trades or withdrawals. For on-chain tracking, you only provide your public wallet address, which is public information. Always use strong, unique passwords and enable 2FA for maximum security.

2. Do I have to pay for a good crypto tracker? Not necessarily. Tools like CoinGecko and DappRadar offer fantastic value for free, especially if you’re comfortable with manual entry or a Web3-only view. Paid plans are typically for power users who need advanced features like unlimited automatic connections, deep tax analysis, or all-in-one asset tracking.

3. Can these trackers help with crypto taxes? Yes, many of them can. Platforms like Accointing are specifically designed for this, but others like CoinStats and Delta also offer transaction history exports that can be used with dedicated crypto tax software. They are invaluable for calculating capital gains and losses.

Conclusion: From Chaos to Clarity in 2025

In the fast-evolving crypto market of 2025, managing your portfolio on a spreadsheet is like navigating a supercar with a map from the 1990s. The right crypto portfolio tracker is your modern GPS—it gives you a real-time, bird’s-eye view of where you are, so you can make intelligent decisions about where you’re going next.

Whether you’re a DeFi power user, a long-term HODLer, or a diversified wealth builder, there is a tool on this list that will bring clarity to your crypto journey. Choose the one that fits your style, connect your accounts, and trade chaos for control.

Once you have that control, the next step is to sharpen your strategy.

Take Your Crypto Strategy to the Next Level

Ready to move beyond tracking and start making data-driven investment decisions?

Contact Scentia Research Group today for a free consultation and discover how our institutional-grade analysis can give you the professional edge you need to thrive in the crypto markets.