The flashing green charts, the “100x” calls on social media, the dizzying rush of a bull market—it’s easy to get swept up in the crypto frenzy. Many people start by buying a coin a friend recommended or one they saw trending online. Sometimes it works out. More often, it leads to sleepless nights and a portfolio that looks more like a lottery ticket than a serious investment.

But what separates a fleeting win from long-term wealth generation? The difference is strategy.

The challenge isn’t just buying crypto; it’s the disciplined process of building a professional portfolio designed to weather volatility and capture sustainable growth. If you’re ready to transition from a speculator to a strategic investor, you’re in the right place. This guide provides the framework professionals use to build, manage, and grow their digital asset portfolios.

Why a “Professional” Approach to Crypto is No Longer Optional

The crypto landscape of today is a world away from its early, niche beginnings. With institutional giants like BlackRock and Fidelity entering the space, digital assets are being recognized as a legitimate component of a modern investment strategy. This maturation means the old rules—or lack thereof—no longer apply.

The “Gambler’s Mindset” is reactive. It’s driven by:

- FOMO (Fear Of Missing Out): Buying at the peak of a hype cycle.

- Emotional Decisions: Panic selling during a dip or getting greedy during a rally.

- Surface-Level “Research”: Relying on influencer tweets and Reddit threads.

In contrast, the “Investor’s Mindset” is proactive. It’s founded on:

- Data-Driven Analysis: Making decisions based on fundamentals and metrics.

- Defined Strategy: Having a clear plan for buying, selling, and managing risk.

- Long-Term Vision: Focusing on the marathon, not the sprint.

Adopting a professional approach is your best defense against market manipulation and extreme volatility. It’s how you build resilience.

The Core Pillars of Building a Professional Crypto Portfolio

A strong portfolio is like a well-built structure; it requires a solid foundation. These four pillars are the essential components for constructing a crypto portfolio that can stand the test of time.

Pillar 1: Defining Your Investment Thesis & Goals

Before you buy a single asset, you must look inward. Your portfolio should be a direct reflection of your personal financial situation and goals. Ask yourself:

- What is my risk tolerance? Are you aggressive, willing to take on high risk for potentially higher returns? Or are you conservative, prioritizing capital preservation? Be honest.

- What is my time horizon? Are you investing for retirement in 20 years, or are you saving for a down payment on a house in three years? A longer time horizon can accommodate more volatility.

- What are my specific financial goals? Are you aiming for a specific return percentage, passive income generation, or simply long-term appreciation?

Actionable Tip: Create a one-page “Personal Investment Mandate.” Write down your goals, risk tolerance, and time horizon. This document will be your north star, guiding you away from impulsive decisions when the market gets chaotic.

Pillar 2: Strategic Asset Allocation

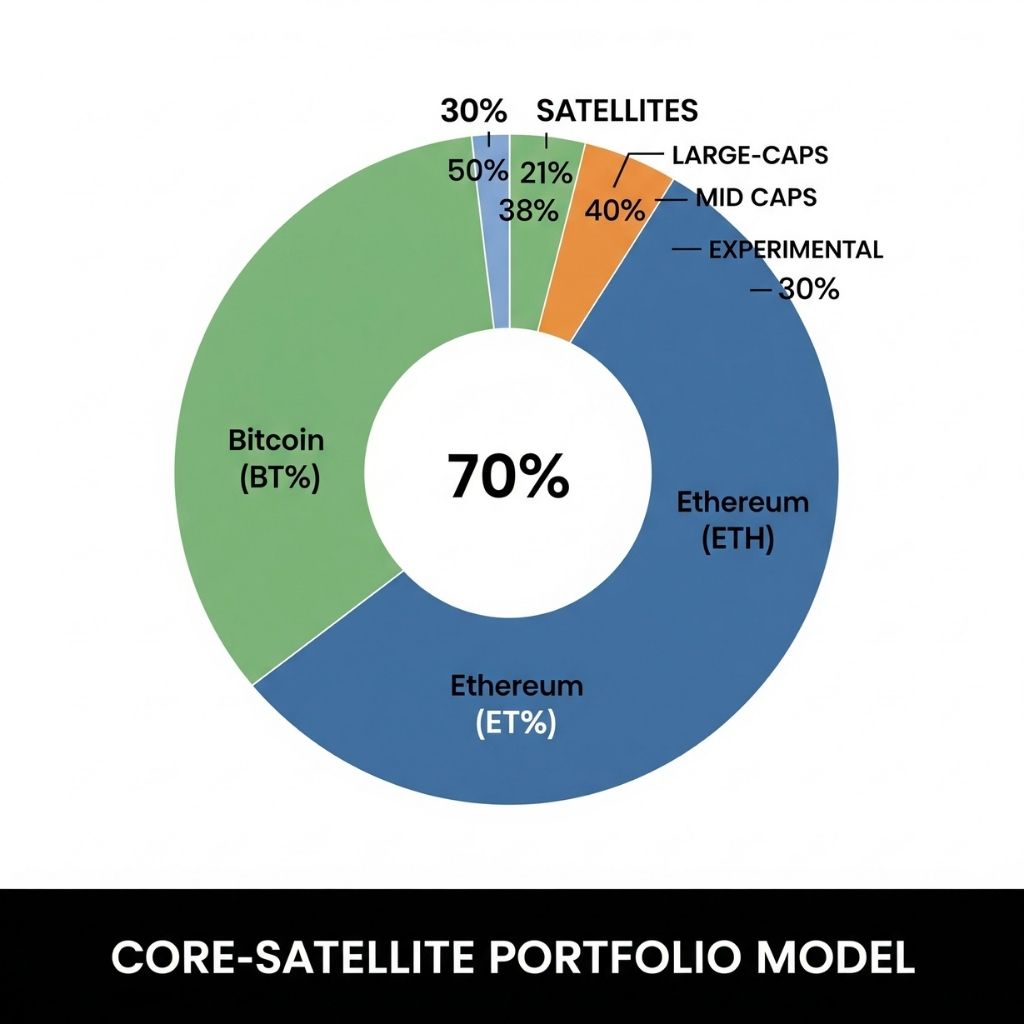

Asset allocation is the single most important decision you will make. It’s the art of balancing risk and reward by diversifying your capital across different types of assets. A popular and effective model for crypto is the Core-Satellite approach.

Your Core (60-80% of Portfolio)

This is the foundation of your portfolio, comprised of the most established, secure, and highly liquid cryptocurrencies.

- Bitcoin (BTC): The original digital asset, often seen as a store of value or “digital gold.” It’s the least volatile of the major cryptos.

- Ethereum (ETH): The leading smart contract platform, powering a vast ecosystem of applications from DeFi to NFTs.

Your core holdings provide stability and act as an anchor, grounding your portfolio during market turbulence.

Your Satellites (20-40% of Portfolio)

These are your higher-risk, higher-reward investments, designed to generate alpha (returns above the market average). You can further segment this portion:

- Large-Cap Altcoins: Established projects in the top 10-20 by market cap with strong ecosystems (e.g., leaders in Layer-1s, Oracles).

- Mid-Cap & Small-Cap Gems: Promising projects in high-growth sectors like Decentralized Finance (DeFi), Blockchain Gaming, or AI. These require significantly more research.

- Experimental Bets (Optional, <5%): A very small allocation to new, high-risk projects. Treat this as venture capital—it could go to zero.

Pillar 3: The Foundation of Due Diligence

“An investment in knowledge pays the best interest.” – Benjamin Franklin

This is where professionals separate themselves. While amateurs chase hype, pros conduct rigorous due diligence. How can you analyze thousands of projects? By creating a repeatable framework. We call it the F.U.N.D.A. Method:

- F – Fundamentals: What real-world problem does this project solve? Is there a clear product-market fit?

- U – Use Case & Tokenomics: Is the token integral to the ecosystem? What is the inflation schedule? Is value accrued to token holders?

- N – Network & Community: Are developers actively building on the platform? Is there a vibrant, organic community, or is it all marketing hype?

- D – Developers & Team: Who is behind the project? Do they have a proven track record? Are they transparent?

- A – Adoption & Partnerships: Are reputable companies or protocols using this technology? Have they secured significant partnerships?

This level of deep-dive research is incredibly time-consuming and requires specialized knowledge. It’s the core mission of firms like Scentia Research Group, which provides institutional-grade analysis to help investors make informed decisions without spending hundreds of hours sifting through whitepapers and Discord channels.

Pillar 4: Mastering Risk Management

In a market that can swing 20% in a day, risk management is not just important; it’s everything.

- Position Sizing: Never go “all-in” on a single asset, especially a speculative one. A general rule is to not allocate more than 5% to any single satellite asset.

- Diversification vs. “Diworsification”: Owning 30 random, low-quality assets isn’t diversification. True diversification means holding uncorrelated or semi-correlated assets across different sectors (e.g., a Layer-1, a DeFi protocol, a gaming token). The Ultimate Guide to Crypto Risk Management

- Know Your Invalidation Point: Before you invest, determine the conditions under which your investment thesis would be proven wrong. If those conditions are met, exit the position without emotion.

A 7-Step Guide to Building Your Professional Portfolio

Ready to put theory into practice? Here is a step-by-step process.

- Step 1: Choose Your Infrastructure: Select a reputable, regulated exchange for purchasing assets and a secure wallet for long-term storage. For significant amounts, a hardware wallet (like Ledger or Trezor) is non-negotiable.

- Step 2: Fund Your Core Position: Begin by building your foundation. Use a Dollar-Cost Averaging (DCA) strategy to buy Bitcoin and Ethereum over time. This mitigates volatility by averaging out your purchase price.

- Step 3: Research & Select Your Satellites: Using the F.U.N.D.A. framework, begin your due diligence on potential satellite investments. This is where leveraging expert analysis from platforms like Scentia Research Group can provide a critical edge and save you from costly mistakes.

- Step 4: Execute Your Buys: Once you’ve identified your assets, acquire them methodically. Avoid making large purchases during periods of extreme market euphoria.

- Step 5: Track Your Portfolio: Use a portfolio tracking app or spreadsheet to monitor your allocations, performance, and overall portfolio value in one place.

- Step 6: Schedule Regular Rebalancing: Over time, some assets will outperform others, skewing your target allocations. Rebalancing involves selling some of your winners and buying more of your underperformers to return to your desired allocation percentages (e.g., 70/30 Core-Satellite). A quarterly or semi-annual rebalance is a common strategy.

- Step 7: Stay Informed (The Right Way): The crypto space evolves at lightning speed. Stay updated, but curate your information sources. Follow data-driven analysts and reputable news outlets, not hype-driven social media accounts. Crypto Data Aggregator Messari

The Scentia Research Group Advantage: From Amateur to Pro

We’ve covered the framework for building a professional portfolio, but there’s a significant barrier for most investors: time and expertise.

Conducting professional-grade due diligence on a single project can take 40+ hours. Doing it for an entire portfolio is a full-time job. How do you find the objective signal in a market filled with deafening noise?

This is the problem Scentia Research Group was created to solve.

We do the heavy lifting for you. Our team of expert analysts dives deep into the technology, tokenomics, and competitive landscapes of digital assets. We provide our members with:

- Comprehensive Project Reports: Unbiased, institutional-grade deep dives that give you everything you need to know.

- Actionable Market Insights: On-chain data analysis and market trend forecasts to help you spot opportunities and risks.

- A Focus on Fundamentals: We cut through the hype to deliver the data that truly matters for long-term investing.

We empower you with the same level of insight that professional fund managers use, allowing you to focus on executing your strategy with confidence and clarity.

Your Journey to Strategic Investing Starts Now

Building a professional portfolio is a deliberate process of planning, research, and discipline. It’s about shifting your mindset from chasing quick gains to strategically building lasting wealth. By defining your goals, allocating assets wisely, doing your homework, and managing risk, you place yourself in the top echelon of crypto investors.

This journey requires the right tools and the right information. You don’t have to navigate it alone.

Ready to elevate your crypto investing strategy? Explore the institutional-grade research and insights from Scentia Research Group and start building your professional portfolio with an expert edge.

[Discover Scentia Research Group Today.]