We’ve all been there. You see a new coin mentioned on Twitter, it’s up 300% in 24 hours, and the fear of missing out (FOMO) kicks in. You jump in, only to watch the price plummet moments later, leaving you holding a bag of digital dust. This rollercoaster of hype-driven investing is exhausting and, more often than not, unprofitable.

So, how do the smart investors consistently find promising projects before they hit the mainstream? They don’t have a crystal ball. They have a framework. They look beyond the price charts and social media noise to evaluate a project’s core value.

This is the art and science of fundamental analysis. If you’re ready to move from gambling to investing, you’ve come to the right place. This guide will teach you how to analyze a cryptocurrency’s fundamentals using a structured, repeatable process, empowering you to make decisions with confidence.

Why Fundamental Analysis in Crypto Matters More Than Ever

In traditional finance, fundamental analysis involves scrutinizing a company’s financial statements, management effectiveness, and industry trends to determine its intrinsic value. In crypto, the principles are the same, but the metrics are different. Instead of P/E ratios, we look at on-chain activity. Instead of quarterly reports, we dissect whitepapers.

With over two million cryptocurrencies in existence and new ones launching daily, the ability to separate signal from noise is a superpower. Technical analysis can tell you when to buy, but fundamental analysis tells you what to buy and why. It’s the difference between riding a fleeting wave and investing in the tide itself.

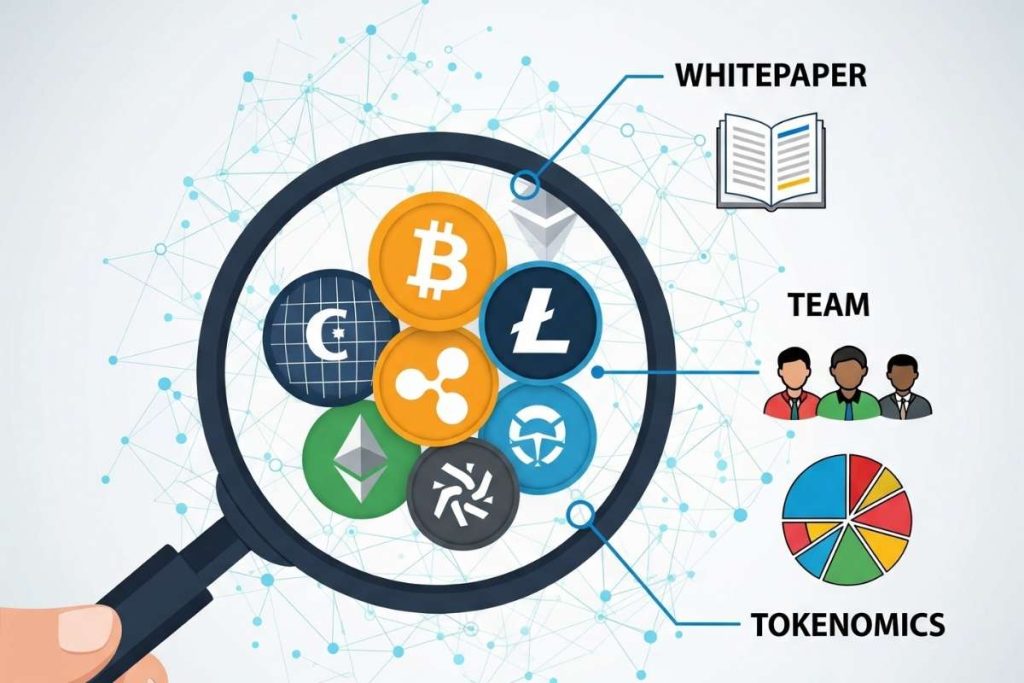

The Three Pillars of Crypto Fundamental Analysis

To effectively evaluate a crypto project, we can break our analysis down into three core pillars. Each pillar helps answer a critical question about the project’s long-term viability.

- Project Analysis (The ‘What’ and ‘Why’): What problem does this project solve, and is its solution viable?

- Financial Analysis (The ‘How’): How is the project’s token designed to capture value, and what do its financial metrics show?

- People Analysis (The ‘Who’): Who is the team behind the project, and who makes up its community?

Let’s break down each pillar step-by-step.

Pillar 1: Project Analysis (The ‘What’ and ‘Why’)

This is where your research begins. You need to understand the project’s purpose and its potential for real-world adoption.

Dissecting the Whitepaper: More Than Just a Document

The whitepaper is the foundational document for any legitimate crypto project. It should clearly outline the project’s goals, the technology behind it, and its go-to-market strategy.

What to look for:

- Clarity and Professionalism: Is the document well-written, or is it full of buzzwords and vague promises? A sloppy whitepaper is a major red flag.

- Technical Details: It should explain the underlying technology (e.g., blockchain architecture, consensus mechanism) in sufficient detail.

- Use Case: It must clearly define the purpose of the cryptocurrency and the network.

Ask yourself: “After reading this, do I have a crystal-clear understanding of what this project does?” If the answer is no, proceed with caution.

The Problem and The Solution: Does it Make Sense?

Many projects are solutions in search of a problem. A successful cryptocurrency must address a real pain point in a way that is significantly better than existing solutions.

- Problem: Does the project identify a specific, significant problem? For example, Bitcoin addresses the need for a decentralized, censorship-resistant store of value.

- Solution: Is the proposed solution practical? Does using a blockchain and a token actually make the solution better, or is it just a gimmick?

- Market Fit: Who are the target users? How large is the potential market? A guide to calculating Total Addressable Market (TAM) in crypto.

Roadmap and Milestones: Are They Delivering?

A roadmap outlines the project’s development timeline and key milestones. It’s a promise to the community.

- Clarity and Realism: Is the roadmap detailed and achievable, or does it promise to “revolutionize the world” by next quarter?

- Track Record: Check the project’s history. Have they met previous deadlines? Consistent delays can signal internal issues.

- GitHub Activity: For open-source projects, check their GitHub repository. Consistent commits and developer activity show that the project is actively being built. A dead GitHub is a sign of an abandoned project.

Pillar 2: Tokenomics & Financial Metrics (The ‘How’)

“Tokenomics”—a portmanteau of “token” and “economics”—is the single most critical element in understanding a crypto asset’s value. It governs the supply, demand, and distribution of a token. This is a crucial part of how to analyze a cryptocurrency’s fundamentals.

Understanding Token Supply: Inflation vs. Deflation

The supply dynamics of a token directly impact its price.

- Total Supply & Circulating Supply: Know the difference. Circulating supply is the number of coins publicly available, while total supply includes locked tokens. Check token supplies on CoinGecko.

- Max Supply: Is there a hard cap on the number of tokens, like Bitcoin’s 21 million? Or is it inflationary with no limit?

- Inflation Rate: If new tokens are created (e.g., through staking rewards or mining), what is the annual inflation rate? High inflation can suppress the price.

- Vesting Schedule: When are locked tokens (for the team, advisors, and early investors) released? A large “token unlock” can create massive sell pressure.

Token Utility: What’s the Real Use Case?

A token needs a reason to exist. Its utility creates organic demand. Common use cases include:

- Paying transaction fees (e.g., ETH on Ethereum)

- Governance rights (e.g., UNI for Uniswap)

- Staking to secure the network

- Accessing a service or product

Ask yourself: “If I hold this token, what can I do with it? Is there a compelling reason for people to buy and hold it beyond speculation?”

Token Distribution: Who Holds the Coins?

A fair distribution is vital for decentralization and long-term health. Look at the initial allocation:

- Team & Advisor Allocation: A high percentage (e.g., >25%) held by insiders is a red flag. It suggests a higher risk of them dumping on the market.

- Public Sale vs. VC Allocation: What portion was sold to the public versus private venture capitalists? VCs often get tokens at a deep discount and may sell as soon as they can.

- Whale Concentration: Use a block explorer to see the top holders. If a few wallets hold a majority of the supply, they can easily manipulate the price.

On-Chain Metrics: A Glimpse into Real Activity

On-chain data provides a transparent view of a network’s health and usage. Key metrics include:

- Daily Active Addresses (DAA): How many unique wallets are interacting with the network daily? Growing DAA indicates user adoption.

- Transaction Volume: How much value is being moved on the network? This reflects economic activity.

- Network Value to Transactions (NVT) Ratio: Often called crypto’s P/E ratio, it compares the market cap to the transaction volume. A high NVT ratio can suggest the asset is overvalued relative to its utility.

Pillar 3: Team & Community Analysis (The ‘Who’)

An idea is only as good as the people executing it. Assessing the human element is non-negotiable.

Investigating the Team: Experience and Transparency

The core team is the driving force behind the project.

- Doxxed or Anonymous?: Is the team public (“doxxed”)? While anonymity was a part of crypto’s cypherpunk roots, a public team is generally a sign of accountability.

- Relevant Experience: Do the founders and developers have a track record in blockchain, software engineering, or the industry they’re targeting? Check their LinkedIn profiles and professional history.

- Communication: How does the team communicate with the community? Are they transparent about progress and setbacks?

Community Engagement: Is it Active or Artificial?

A strong, organic community is a powerful asset. It provides support, drives adoption, and helps secure the network.

- Platform Health: Check their Discord, Telegram, and Twitter. Are people having meaningful discussions, or is it just filled with “wen moon?” bots?

- Community Size vs. Engagement: A project with 100,000 Twitter followers but only 2 likes per tweet has a fake community. Look for genuine engagement relative to size.

- Developer Community: Is there a thriving ecosystem of developers building on top of the protocol? This is a strong indicator of long-term potential.

Strategic Partnerships and Backers

Reputable backers and partners lend credibility and can open doors for a project.

- Venture Capital: Who are the lead investors? Backing from top-tier VCs like Andreessen Horowitz (a16z) or Paradigm is a strong signal.

- Partnerships: Are their announced partnerships with established companies genuine and meaningful? A “partnership” that’s just a press release with no real integration is worthless.

Putting It All Together: Your Crypto Analysis Checklist

Here is a quick checklist to guide your research process.

- [ ] Project & Whitepaper:

- Is the problem it solves real?

- Is the whitepaper clear and detailed?

- Is the roadmap realistic and are they hitting milestones?

- [ ] Tokenomics:

- Is the supply capped or inflationary?

- Does the token have a clear utility?

- Is the token distribution fair and decentralized?

- When are the major token unlocks?

- [ ] Financials & On-Chain Data:

- What is the market cap and fully diluted valuation?

- Are daily active addresses and transaction volumes growing?

- [ ] Team & Community:

- Is the team public and experienced?

- Is the community active and organic?

- Are there reputable backers and partners involved?

The Scentia Research Group Advantage: From Data to Decision

As you can see, a proper deep dive into how to analyze a cryptocurrency’s fundamentals is an intensive process. It requires technical knowledge, hours of research, and the ability to connect disparate data points into a coherent investment thesis.

While this framework provides a powerful toolkit, performing this level of due diligence on every potential investment can be a full-time job. That’s where Scentia Research Group comes in.

Our team of expert analysts does the heavy lifting for you. We apply a rigorous, multi-faceted research methodology—covering everything discussed here and more—to identify high-potential projects in the digital asset space. We distill hundreds of hours of research into institutional-grade reports that give you clear, actionable insights, saving you time and helping you invest with clarity and confidence.

Conclusion: Beyond the Hype, Towards Informed Investing

Learning how to evaluate crypto projects on your own is one of the most valuable skills you can develop as an investor. It empowers you to look past the fleeting narratives and identify projects with the potential for enduring value. By systematically analyzing a project’s core concept, its financial design, and the people behind it, you can build a robust portfolio designed to weather any market cycle.

Stop chasing pumps. Start investing in fundamentals.

Ready to elevate your investment strategy with professional-grade crypto analysis?

Explore Scentia Research Group’s latest reports and discover your next great investment.