Remember the explosive rise and catastrophic fall of projects like LUNA? For many, it was a harsh lesson in a critical, yet often overlooked, aspect of cryptocurrency: tokenomics. A flashy website and a charismatic founder can capture attention, but it’s the underlying economic structure that ultimately determines if a project will soar or sink. Get it wrong, and you build a house of cards. Get it right, and you create a self-sustaining digital economy.

But how can you tell the difference? How do you look past the hype and analyze the core mechanics of a digital asset? This is where a deep dive on tokenomics models becomes not just helpful, but essential for any serious investor, builder, or enthusiast in the crypto space. It’s the skill that separates gambling from strategic investing.

In this comprehensive guide, we’ll move beyond simple definitions. We will dissect the key components that make up a token’s DNA and explore the most common models you’ll encounter in the wild.

What Exactly is Tokenomics? Beyond the Buzzword

“Tokenomics” is a portmanteau of “token” and “economics.” At its core, it’s the science of a token’s economy. It encompasses all the factors that influence a cryptocurrency’s value, including its creation, its supply, its distribution mechanisms, and the incentives designed to encourage user behavior.

Think of it as the monetary policy for a decentralized ecosystem. Just as a central bank uses tools like interest rates and quantitative easing to manage a national currency, a crypto project uses its tokenomics model to manage its native token.

A project’s tokenomics answers critical questions like:

- How many tokens will ever exist?

- How are new tokens created and distributed?

- What is the token’s actual purpose within the network?

- What mechanisms are in place to drive demand and create value over time?

Understanding these elements is the first step in conducting a thorough tokenomics analysis.

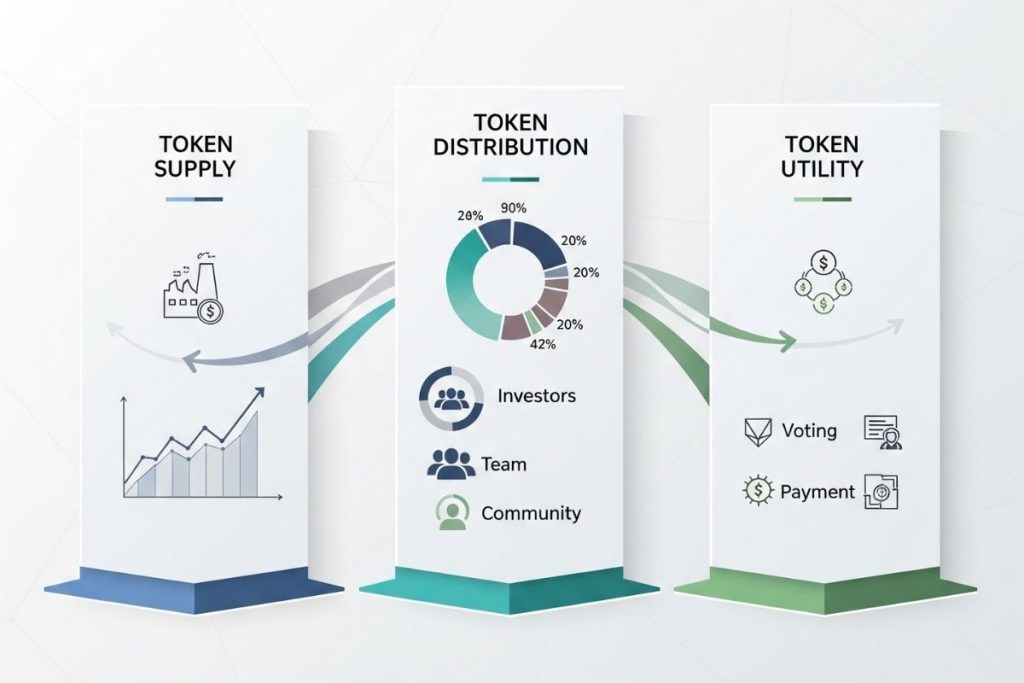

The Core Pillars of Any Tokenomics Model

Every tokenomics model, regardless of its complexity, is built on three fundamental pillars. A weakness in any one of these can jeopardize the entire project.

Token Supply: The Scarcity Factor

Supply is the most straightforward aspect of tokenomics. It dictates how many tokens exist and how that number might change over time.

- Max Supply: This is the absolute maximum number of tokens that will ever be created. Bitcoin, for example, has a hard-capped max supply of 21 million BTC, which is fundamental to its “digital gold” narrative. A fixed max supply creates inherent scarcity.

- Circulating Supply: This is the number of tokens currently available and circulating on the market. A large discrepancy between the circulating supply and the total supply can indicate that many tokens are locked up (e.g., for vesting) and could create future sell pressure.

- Inflationary vs. Deflationary:

- Inflationary Models: New tokens are continuously created, typically as rewards for miners or stakers who secure the network (e.g., Ethereum). A well-designed inflationary model must ensure that the utility and demand for the token grow faster than its supply.

- Deflationary Models: The total supply of the token decreases over time. This is often achieved through “token burns,” where a percentage of transaction fees are permanently removed from circulation (e.g., Binance Coin – BNB). This aims to increase the value of the remaining tokens.

Token Distribution: Who Gets What and When?

How a project initially distributes its tokens is a massive indicator of its long-term viability and fairness. A heavily centralized distribution can pose significant risks.

- Initial Coin Offerings (ICOs) & Pre-sales: Early funding rounds where tokens are sold to venture capitalists and early investors. It’s crucial to examine the prices they paid and, more importantly, their vesting schedules.

- Vesting Schedules: A vesting schedule is a timeline that dictates when early investors and team members can sell their tokens. A long vesting period (e.g., 3-4 years) signals a long-term commitment, while a short one can lead to massive sell-offs (or “dumps”) as soon as the lock-up period ends.

- Fair Launch: A distribution method where the token is released to the public without any early-access rounds for VCs or insiders. Bitcoin is the prime example of a fair launch.

- Airdrops: Tokens are distributed for free to users of a specific platform or holders of another cryptocurrency, often to bootstrap a community and decentralize governance.

Token Utility: Why Does This Token Even Exist?

Utility is what gives a token a reason to be held or used beyond pure speculation. Without strong utility, a token is just a number on a screen.

- Governance: Holders can vote on proposals that shape the future of the protocol. This gives users a direct stake in the project’s success (e.g., UNI, AAVE).

- Staking & Network Security: Users can lock up (stake) their tokens to help secure the network and, in return, earn rewards or a share of the network’s revenue. This is the cornerstone of Proof-of-Stake blockchains.

- Medium of Exchange: The token is used as the primary currency within an ecosystem to pay for services, goods, or transaction fees (e.g., ETH for gas fees on Ethereum).

- Access Rights: Holding the token grants access to exclusive features or services within an application.

A Deep Dive on Tokenomics Models: Common Archetypes

Now that we understand the pillars, let’s explore how they are combined to create common tokenomics models. Our deep dive on tokenomics models wouldn’t be complete without looking at real-world examples.

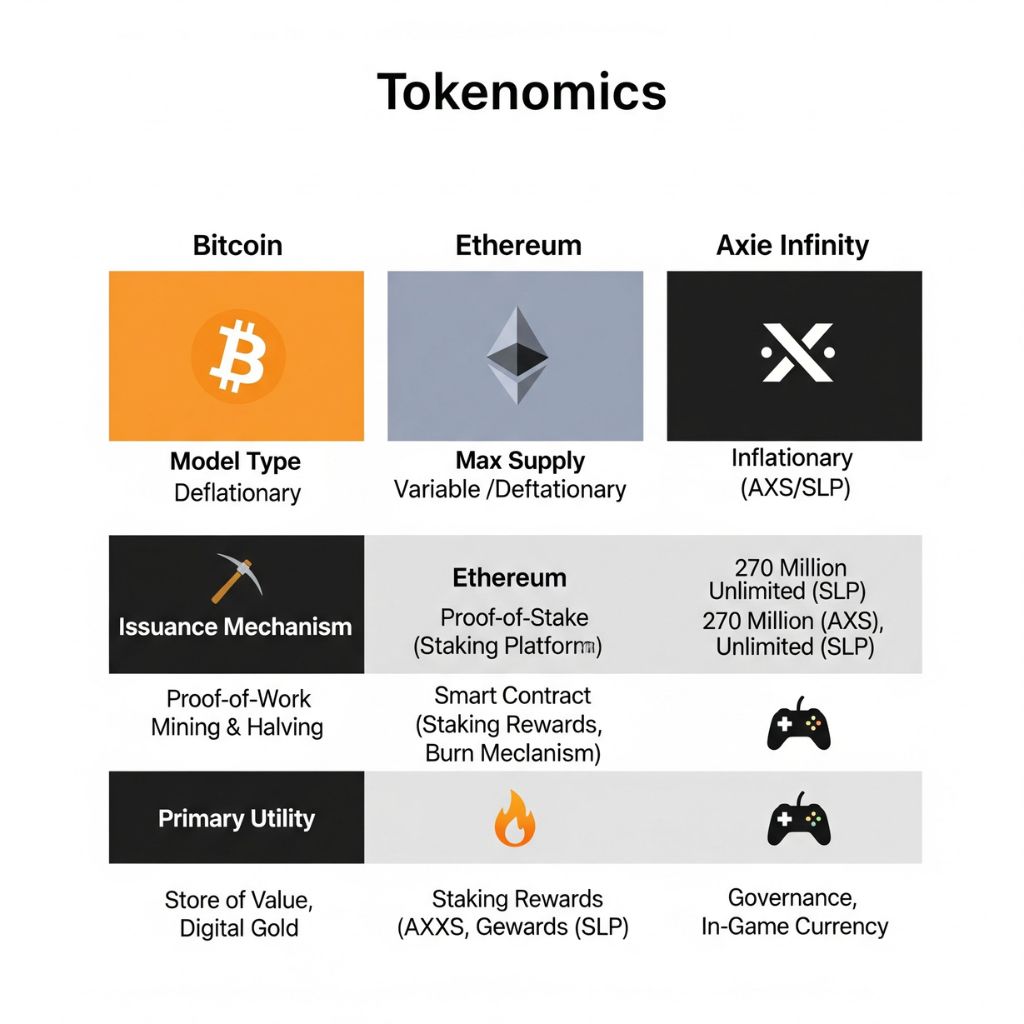

1. The Deflationary “Store of Value” Model

- Description: This model is defined by a fixed, or decreasing, supply. The primary goal is to create a scarce asset that holds or increases its value over time, acting as a hedge against the inflation of traditional currencies.

- Mechanism: Hard supply cap and/or token burns.

- Example: Bitcoin (BTC)

- Supply: Hard-capped at 21 million.

- Distribution: A fair launch via mining, with a “halving” event every four years that reduces the rate of new supply creation.

- Utility: Primarily a store of value and a medium of exchange.

2. The Inflationary “Work & Stake” Model

- Description: This model uses a perpetual, but controlled, inflation rate to incentivize participation and security. The value is not derived from absolute scarcity but from the network’s utility and the demand for its blockspace.

- Mechanism: Block rewards for miners or staking rewards for validators.

- Example: Ethereum (ETH)

- Supply: No maximum supply, but its issuance rate has been significantly reduced. Following “The Merge,” ETH can become deflationary during periods of high network activity due to its fee-burning mechanism (EIP-1559 explanation).

- Distribution: A mix of pre-mine and ongoing issuance via staking rewards.

- Utility: Used to pay for gas fees (computation), stake to secure the network, and as the base currency for the massive DeFi and NFT ecosystems.

3. The Dual-Token Model

- Description: Often found in blockchain gaming (GameFi), this model uses two separate tokens: a governance token (often with a fixed supply) and a utility/reward token (typically with an uncapped, inflationary supply). The goal is to separate speculative value from in-game economy functions.

- Mechanism: Players earn the utility token, which they can use or sell. The governance token represents a stake in the overall project.

- Example: Axie Infinity (AXS & SLP)

- AXS (Governance): Capped supply, used for staking and voting.

- SLP (Utility/Reward): Uncapped supply, earned by playing the game and used for breeding new Axies. This model faced challenges when the creation of SLP vastly outpaced its utility (burning mechanisms), leading to hyperinflation.

How to Analyze a Project’s Tokenomics: A Framework from Scentia Research Group

Analyzing tokenomics can feel like detective work. You need to know where to look and what questions to ask. At Scentia Research Group, our analysts use a rigorous framework to cut through the noise. Here are the foundational steps you can apply.

Step 1: Read the Whitepaper (and the Fine Print)

The project’s whitepaper is your primary source. Look for a dedicated “Tokenomics” or “Token Economy” section. Pay close attention to:

- The exact numbers for total supply.

- The allocation percentages (e.g., 20% to team, 30% to ecosystem fund, etc.).

- The specific utility of the token.

Step 2: Scrutinize the Vesting Schedule

This is non-negotiable. Find the token release or vesting schedule. If it’s not clearly provided, that’s a major red flag.

- Look for cliffs: A “cliff” is an initial period where no tokens are unlocked. A 6-12 month cliff for team and investor tokens is a good sign.

- Check the release period: Are tokens released gradually over 2-4 years (good) or all at once after a short cliff (bad)? A sudden, large unlock can create immense sell pressure, crashing the token’s price.

Step 3: Map the Value Accrual Mechanism

Ask yourself: “How does value flow back to the token?”

- Does the protocol generate revenue (e.g., from trading fees, lending interest)?

- Is a portion of that revenue used to buy back and burn the token, or is it distributed to token holders/stakers?

- If the only reason to hold the token is to earn more of the same token via inflation, the model may be unsustainable without external demand.

Step 4: Assess the Sell Pressure vs. Buy Pressure

Finally, put it all together.

- Sell Pressure: Comes from inflationary rewards and tokens unlocking from vesting schedules.

- Buy Pressure: Comes from the token’s utility. People need to buy the token to pay fees, participate in governance, or access services.

A sustainable tokenomics model is one where the buy pressure is designed to consistently absorb the sell pressure over the long term.

The Scentia Research Group Advantage: Navigating Complex Tokenomics

This deep dive on tokenomics models provides a foundational understanding, but the crypto landscape is constantly evolving with new and more complex economic designs. Properly vetting a project requires specialized expertise and hours of dedicated research—resources that most individual investors and even project teams lack.

This is where Scentia Research Group provides unparalleled value. Our team of analysts goes beyond the surface, stress-testing economic models, simulating market conditions, and providing institutional-grade research that empowers our clients to make informed decisions. We help investors identify projects with robust, sustainable tokenomics and assist builders in designing economic systems that thrive.

Don’t leave your success to chance. Understanding the economic engine of a crypto project is the most crucial part of your due diligence.

Ready to move from speculation to strategy?Tokenomics can be incredibly complex, and a flawed model can be fatal to your investment or project. Let the experts at Scentia Research Group bring clarity and confidence to your crypto strategy.