The cryptocurrency market, with its trillion-dollar valuation, is more than just a fleeting trend—it’s a new financial frontier. Behind the thrilling volatility and groundbreaking technology are the sharp minds making sense of it all: crypto analysts. They are the digital detectives and financial storytellers of the Web3 era.

But as you stare at the complex charts and endless stream of data, you might be wondering, “How do I even start?” The path seems complex, demanding a rare blend of finance, tech, and data science skills.

If you’re looking to break into this exciting and lucrative field, you’re in the right place. This guide is your step-by-step roadmap. We’ll demystify the process and show you exactly how to become a crypto analyst, from building foundational knowledge to landing your first job.

What Does a Crypto Analyst Actually Do?

Before diving into the “how,” let’s clarify the “what.” A crypto analyst, also known as a digital asset analyst or blockchain researcher, is a professional who evaluates cryptocurrencies, tokens, and blockchain projects to determine their investment potential and risk.

Their day-to-day responsibilities are diverse and dynamic. They don’t just stare at price charts. A typical day might involve:

- Fundamental Analysis: Researching the team behind a project, its whitepaper, tokenomics (the economics of the crypto token), and its competitive landscape.

- On-Chain Analysis: Analyzing data directly from a blockchain ledger to gauge network health, user activity, and transaction patterns. This is unique to the crypto space.

- Technical Analysis: Using charting tools and statistical indicators to identify trends and predict future price movements based on historical data.

- Market Research & Reporting: Staying on top of industry news, regulatory changes, and macroeconomic trends, then compiling their findings into detailed reports for investors, traders, or their firm.

- Quantitative Modeling: Building financial models to forecast asset prices and assess risk.

Essentially, a crypto analyst’s job is to cut through the hype and noise to provide clear, data-driven insights.

Is Being a Crypto Analyst a Good Career?

Absolutely. The demand for skilled crypto analysts is exploding. As institutional investors, hedge funds, and traditional finance companies enter the digital asset space, they need experts who can navigate its complexities.

Here’s why it’s a compelling career path:

- High Demand & Compensation: The talent pool is still relatively small, leading to competitive salaries. Glassdoor crypto analyst salary data often shows six-figure incomes, even for mid-level roles.

- Intellectually Stimulating: You’ll be at the forefront of financial innovation, constantly learning about new technologies and economic models.

- Impactful Work: Your analysis can directly influence major investment decisions and shape the future of a rapidly growing industry.

Now, let’s get to the core of it. Here is your actionable plan.

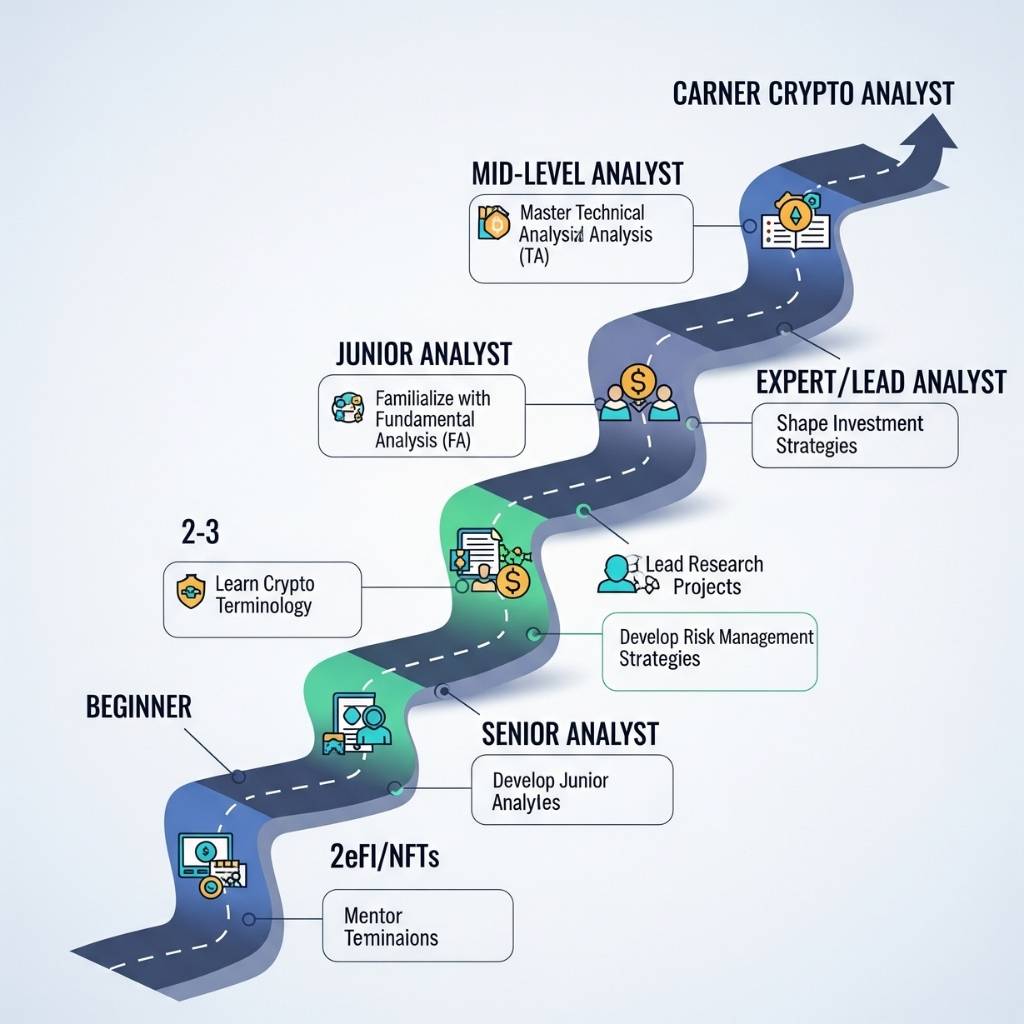

How to Become a Crypto Analyst: A 7-Step Roadmap

Breaking into this field requires dedication and a structured approach. Follow these seven steps to build the skills and experience necessary to succeed.

Step 1: Build a Strong Foundational Knowledge

You can’t analyze what you don’t understand. Before touching any data, immerse yourself in the fundamentals.

- Master Blockchain Basics: Understand how blockchains like Bitcoin and Ethereum work. Learn key concepts like decentralization, consensus mechanisms (Proof-of-Work vs. Proof-of-Stake), and smart contracts.

- Learn Traditional Finance Principles: Crypto doesn’t exist in a vacuum. A solid grasp of market dynamics, valuation methods, portfolio management, and risk assessment is crucial.

- Study Economics & Game Theory: Understanding concepts like monetary policy, inflation, and how incentives drive user behavior (game theory) is critical for analyzing tokenomics.

Actionable Tip: Dedicate 30 minutes every day to reading. Follow industry news sites like CoinDesk and The Block, and read seminal whitepapers like the Bitcoin whitepaper and the Ethereum whitepaper.

Step 2: Master Key Technical & Analytical Skills

This is where you move from theory to practice. A great crypto analyst combines qualitative research with hard quantitative skills.

Must-Have Hard Skills:

- Data Analysis: Proficiency in Python (with libraries like Pandas and NumPy) or R is the industry standard for manipulating and analyzing large datasets.

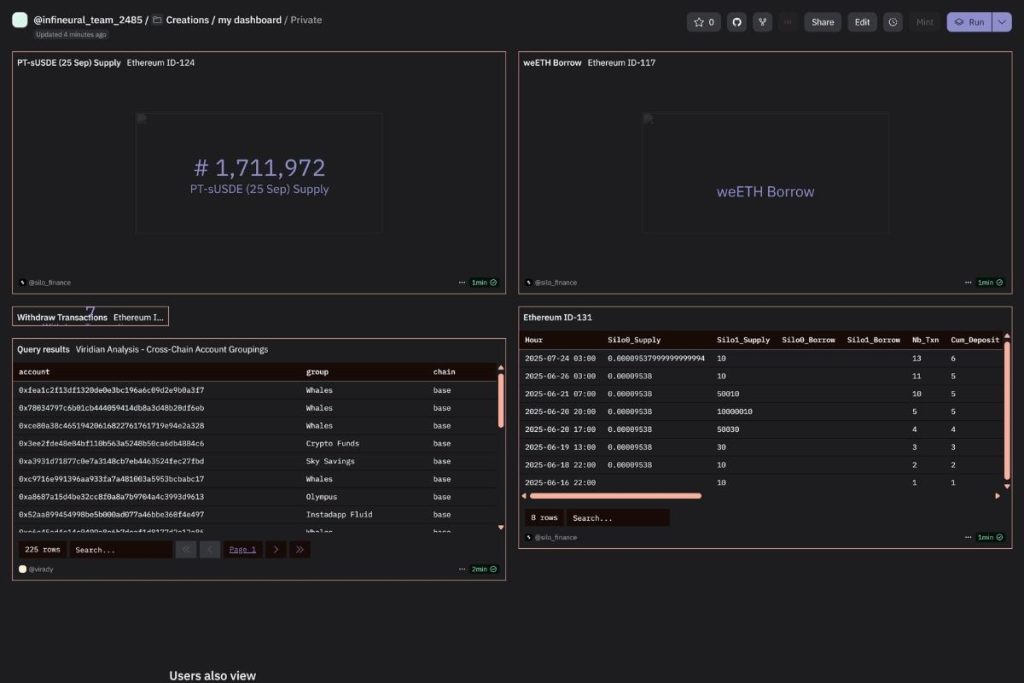

- SQL: Blockchains are essentially massive databases. You’ll need SQL to query on-chain data from platforms like Dune Analytics or Flipside Crypto.

- Statistics & Probability: You need a strong grasp of statistical concepts to build models, understand risk, and avoid drawing false conclusions from data.

- Data Visualization: The ability to present complex data in a clear, compelling way is non-negotiable. Master tools like Tableau, Power BI, or even Python’s Matplotlib/Seaborn libraries.

- Financial Modeling: You should be comfortable building valuation models and forecasts in Excel or Google Sheets.

Essential Soft Skills:

- Critical Thinking: The ability to question assumptions and look beyond surface-level data.

- Communication: You must be able to explain complex topics clearly to both technical and non-technical audiences.

- Curiosity & Adaptability: The crypto space changes daily. A relentless desire to learn is your most valuable asset.

Step 3: Get Hands-On with Essential Tools

Theory is one thing; applying it is another. Familiarize yourself with the tools that professional crypto analysts use every day.

- On-Chain Data Platforms: Glassnode, Dune Analytics, and Nansen. Spend time exploring their dashboards and learning to write your own SQL queries on Dune.

- Market Data Aggregators: CoinMarketCap, CoinGecko, and Messari. These are your go-to sources for price data, market cap information, and project fundamentals.

- Charting Software: TradingView is the gold standard for technical analysis. Learn its tools and practice identifying trends and patterns.

- News & Research Terminals: The Block Pro and other institutional platforms provide deep-dive research and data.

Step 4: Gain Practical Experience (Even Without a Job)

You don’t need to be employed to start building your portfolio. The best way to learn how to become a crypto analyst is by being one.

- Start a Blog, Substack, or Twitter Thread Series: Pick a project you find interesting and conduct a deep-dive analysis. Publish your findings. This showcases your skills, writing ability, and thought process.

- Participate in Bounties: Platforms like Flipside Crypto offer bounties (paid in crypto) for answering specific data questions using SQL. This is an incredible way to build real-world experience.

- Contribute to DAOs: Many Decentralized Autonomous Organizations (DAOs) need data analysis. Join a DAO’s Discord, find their analytics channel, and start contributing.

- Manage a (Small) Personal Portfolio: Having skin in the game is the fastest way to learn. Track your own investments, write down your theses, and analyze your decisions—good and bad.

Step 5: Earn Relevant Certifications (Optional but Recommended)

While not always mandatory, certifications can validate your knowledge and help your resume stand out.

- Chartered Financial Analyst (CFA): The gold standard in the investment management industry. It demonstrates a deep understanding of finance, which is highly respected.

- Certified Blockchain Expert (CBE): Offered by organizations like the Blockchain Council, this shows a verified level of expertise in the underlying technology.

- Data Science / Analytics Certifications: Courses from platforms like Coursera or edX on Python, SQL, and data science can formally prove your technical skills.

Step 6: Network Like a Pro in the Crypto Space

Your network is your net worth, and this couldn’t be truer in crypto.

- Be Active on Crypto Twitter (X): Follow and engage with top analysts, researchers, and builders. Share your own analyses and contribute to the conversation.

- Join Discord & Telegram Groups: These are the digital town halls of crypto. Find communities focused on research and analysis.

- Attend Virtual & In-Person Conferences: Events like Consensus, ETHDenver, and others are fantastic opportunities to meet people and learn from the best in the industry.

Step 7: Craft a Killer Resume and Portfolio

Now it’s time to put it all together.

- Your Resume: Tailor it for each job application. Use keywords from the job description. Highlight your skills and quantify your achievements (e.g., “Published a research report that received 10,000 views”).

- Your Portfolio: This is your most powerful tool. Create a personal website or a professional GitHub profile that showcases your best work. Include links to your published articles, your Dune Analytics dashboard, and any analysis you’ve done. This is tangible proof of your abilities.

Read our guide on building a professional portfolio

Accelerate Your Journey with Professional Insights

Once you have the fundamentals down, the fastest way to sharpen your analytical skills is to learn from the best. Reading and deconstructing institutional-grade research is like having a mentor guide you through the market. It teaches you how top-tier professionals structure their arguments, what data they prioritize, and how they identify emerging trends.

This is where Scentia Research Group comes in. Our team produces in-depth, unbiased analysis on digital assets, designed for sophisticated investors. By studying our reports, you can:

- Understand Institutional Frameworks: See firsthand how professional analysts evaluate projects, assess risk, and identify opportunities.

- Discover Key Metrics: Learn which on-chain and fundamental metrics truly matter when separating signal from noise.

- Stay Ahead of the Curve: Gain access to expert insights on the latest narratives and technological breakthroughs shaping the crypto landscape.

Instead of just learning in a vacuum, you can benchmark your own analysis against industry-leading research.

Your Future in Crypto Awaits

Becoming a crypto analyst is a challenging but incredibly rewarding journey. It requires a unique blend of financial acumen, technical skill, and insatiable curiosity. By following this roadmap, you can systematically build the expertise needed to break into this dynamic field.

Start with the fundamentals, get your hands dirty with data, build a public portfolio of your work, and never stop learning. The digital frontier is waiting for its next generation of expert analysts—and that could be you.

Ready to deepen your understanding of the crypto markets?