The cryptocurrency market is a paradox. It’s a space of unprecedented innovation and wealth creation, yet it’s also rife with noise, hype, and overwhelming complexity. For every groundbreaking project, there are a dozen with flashy marketing and hollow fundamentals. How do you separate the signal from the noise? How do you invest with conviction when the landscape shifts daily?

The answer isn’t a secret trading algorithm or an insider tip. It’s a process. It’s a disciplined, repeatable, and transparent research methodology.

At Scentia Research Group, our entire value proposition is built on the foundation of our analytical process. We don’t guess; we analyze. We don’t follow hype; we follow data. This article pulls back the curtain to show you the exact research methodology we employ to navigate the chaotic crypto markets, identify high-potential assets, and deliver the institutional-grade insights our clients rely on.

Why a Rigorous Research Methodology is Non-Negotiable in Crypto

In traditional finance, investors benefit from decades of standardized reporting, regulatory oversight, and established valuation models. In crypto, these frameworks are still in their infancy. This creates unique challenges:

- Information Asymmetry: Project teams often hold significantly more information than the average investor.

- Market Volatility: Prices can swing dramatically based on social media trends, narrative shifts, or macroeconomic factors, often decoupling from fundamental value.

- Technical Complexity: Understanding the nuances of blockchain technology, smart contracts, and cryptographic principles is essential for true due diligence.

Without a structured research methodology, investors are essentially flying blind—making decisions based on emotion, speculation, and incomplete information. A robust framework turns chaos into clarity, providing a defense against hype and a systematic way to build a strong investment thesis.

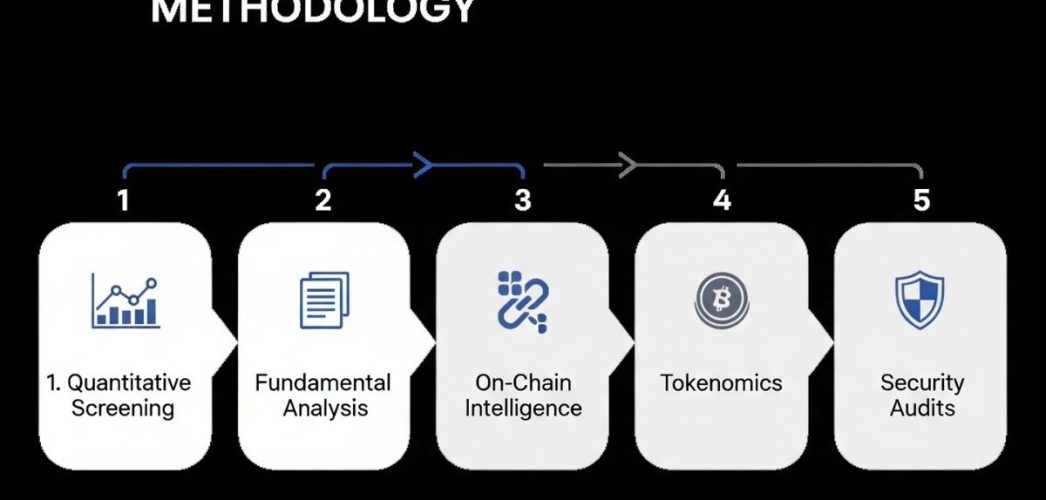

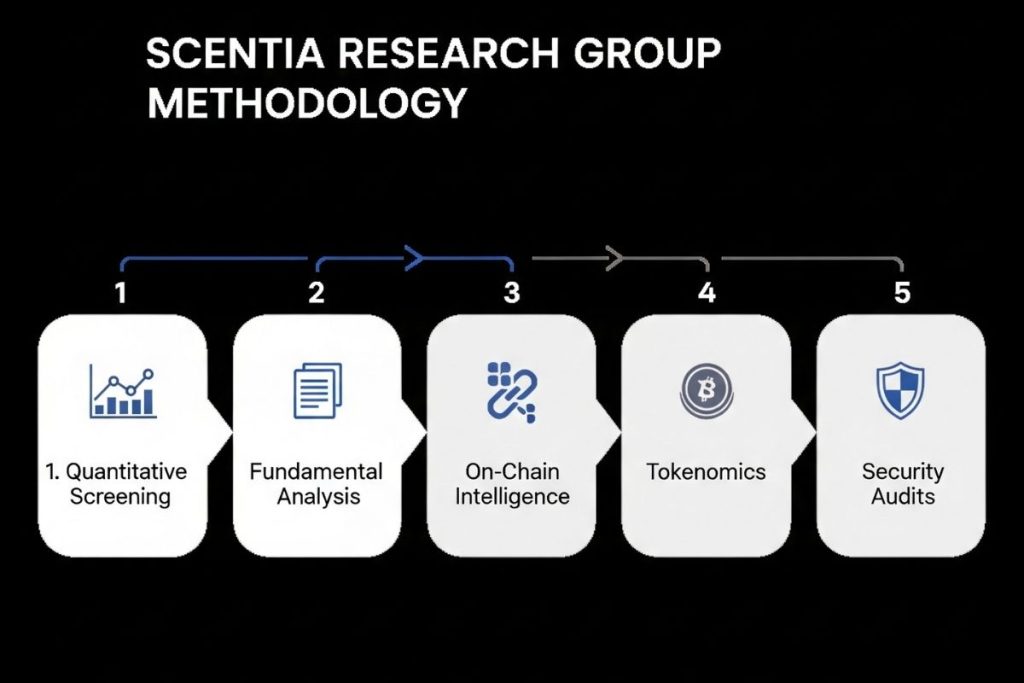

The Scentia Framework: Our Core Research Methodology Pillars

Our approach is not a simple checklist; it’s a multi-faceted analytical framework designed to build a holistic understanding of a crypto asset. We synthesize data from dozens of sources, moving from a high-level quantitative screen to a granular qualitative and technical deep dive.

Our research methodology is built upon five core pillars.

Pillar 1: Quantitative Screening & Data Analysis

Before we spend a single minute reading a whitepaper, we let the data do the initial talking. This phase is about identifying projects with tangible signs of market traction and filtering out illiquid or nascent assets that don’t yet meet our criteria.

Key metrics we analyze:

- Market Data: We look at market capitalization, fully diluted valuation (FDV), trading volume, and liquidity across major exchanges. A high FDV-to-market-cap ratio can be a red flag for future token inflation.

- Social & Development Metrics: Using tools like

[external link: Santiment]or custom scripts, we track social media sentiment, developer activity on GitHub, and community growth trends on platforms like Discord and Telegram. Consistent development activity is a powerful indicator of a project’s long-term health. - Comparative Analysis: We benchmark a project’s key metrics against its direct competitors to understand its relative position within its specific market niche.

This quantitative approach provides an unbiased first pass, allowing us to focus our deeper research efforts on projects that already demonstrate signs of life.

Pillar 2: Qualitative Deep Dive & Fundamental Analysis

Once a project passes our quantitative screen, we move to the core of our fundamental analysis. This is where we go beyond the numbers to understand the story, the vision, and the people behind the project. Our crypto analysis framework is designed to answer one key question: Does this project solve a real problem in a sustainable way?

Our fundamental review process includes:

- The Whitepaper & Documentation: We dissect the whitepaper not for marketing language, but for technical feasibility, economic logic, and a clear problem statement. Is the proposed solution truly enhanced by blockchain technology, or is it a “solution in search of a problem”?

- The Team & Backers: We conduct thorough due diligence on the core team. What is their track record? Do they have the technical and business expertise to execute their vision? We also examine the project’s investors and partners for signs of “smart money” conviction.

- Roadmap & Execution: A roadmap is a promise. We analyze a project’s roadmap for clarity and ambition, but more importantly, we audit their track record of meeting previous deadlines. A history of consistent delivery is a strong positive signal.

- Community & Governance: We immerse ourselves in the project’s community on Discord and governance forums. Is the community engaged and constructive, or is it purely focused on price speculation? How are key decisions made? A decentralized and active governance model is a sign of a healthy, long-term ecosystem.

Pillar 3: On-Chain Intelligence & Network Health

On-chain data is the ground truth of the crypto world. It allows us to verify a project’s claims and measure its actual usage and economic activity directly from the blockchain ledger. This is a crucial part of our research methodology that provides insights unavailable in traditional markets.

Key on-chain metrics we monitor using platforms like Glassnode or Nansen:

- Transaction Volume & Count: Is the network actually being used for its intended purpose?

- Active Addresses: How many unique wallets are interacting with the protocol daily/weekly? A growing user base is a fundamental driver of value.

- Total Value Locked (TVL): For DeFi protocols, TVL is a primary measure of market trust and liquidity. We analyze its growth, stability, and composition.

- Holder Distribution: We analyze the distribution of tokens to identify potential centralization risks from large “whale” holders or the project’s treasury.

Analyzing on-chain data allows the Scentia Research Group team to validate the narrative with real, verifiable activity.

Pillar 4: Tokenomics & Value Accrual

A brilliant project with broken tokenomics is a poor investment. Tokenomics—the economics of the crypto token—is arguably the most critical component of our analysis. It determines how value is created, distributed, and sustained within the ecosystem.

Our tokenomics analysis framework covers:

- Supply Dynamics: Is the token supply fixed (like Bitcoin) or inflationary? What is the inflation/emission schedule? High, perpetual inflation can exert constant sell pressure on the price.

- Vesting & Distribution: We scrutinize the token allocation and vesting schedules for the team, advisors, and early investors. A long vesting period aligns incentives for the long term, while a short one can lead to significant sell pressure as early tokens unlock.

- Value Accrual Mechanism: How does holding the token generate value for its owner? Does it grant governance rights, a share of protocol revenue (e.g., via staking), or access to specific services? The token must be integral to the ecosystem’s success.

- Token Utility: What is the token used for? Is it for paying gas fees, participating in governance, or as collateral? A token with multiple, high-demand use cases has a much stronger foundation for value.

Read our deep dive on tokenomics models here

Pillar 5: Security Audits & Risk Assessment

In an industry where billions have been lost to hacks and exploits, security is not an optional extra—it’s paramount. Our final pillar involves a comprehensive assessment of a project’s technical security and potential risks.

Our security due diligence includes:

- Smart Contract Audits: We verify that the project has been audited by reputable security firms like

Trail of Bitsor CertiK. We don’t just check the box; we read the audit reports to see the severity of the findings and whether they have been addressed by the development team. - Code Review: For key infrastructure, our technical analysts may perform a high-level review of the source code to assess its quality and adherence to best practices.

- Economic Attack Vectors: We assess the protocol for potential economic exploits or game-theoretical weaknesses that could be leveraged by malicious actors.

This rigorous risk assessment is a final, critical filter in our research methodology, ensuring we only highlight projects that demonstrate a serious commitment to security and user safety.

From Raw Data to Actionable Insights

These five pillars don’t exist in a vacuum. The true power of the Scentia Research Group‘s research methodology is in the synthesis. We combine the quantitative data, the qualitative story, the on-chain evidence, the economic model, and the security profile to build a comprehensive investment thesis.

This thesis weighs the potential upside against the identifiable risks, providing a nuanced, 360-degree view of the asset. The output of this exhaustive process is what you see in our reports: clear, concise, and actionable intelligence designed to empower your investment decisions. We do the thousands of hours of research so you can focus on strategy.

Take the Next Step: See Our Methodology in Action

Reading about a process is one thing. Seeing the results is another. Our rigorous research methodology is the engine that drives every report, analysis, and insight we publish. If you’re tired of navigating the crypto market on hype and speculation, it’s time for a more disciplined approach.

Explore our latest market reports to see our analysis in action. Gain the institutional-grade edge you need to invest with confidence.