Do you remember DeFi Summer in 2020? Or the explosive NFT and Metaverse boom of 2021? For many investors, these trends seemed to erupt out of nowhere, minting millionaires overnight and leaving everyone else scrambling to catch up. But what if I told you they weren’t random?

These market-shaking movements were driven by powerful stories, or what industry insiders call “crypto narratives.”

Failing to grasp these narratives is like trying to navigate the ocean without a compass. You might see the waves (daily price action), but you’ll miss the underlying currents (the major trends) that dictate where the market is truly heading. This leads to missed opportunities, chasing hype too late, and frustration.

This guide is your compass. We will break down exactly what crypto narratives are, why they are arguably the most powerful force in the digital asset space, and how you can develop the skill of understanding crypto narratives to make more informed, forward-thinking investment decisions.

What Exactly Are Crypto Narratives?

At its core, a crypto narrative is the collective story or belief system that a large group of market participants adopts to justify a cryptocurrency’s or sector’s potential future value. It’s the “why” behind the price action.

Think of it as the script for the market’s next big play. While fundamentals like transaction volume, total value locked (TVL), and technology are the actors and props, the narrative is the plot that gets the audience (investors) excited.

- Fundamentals tell you what a project is.

- Narratives tell you what a project could be.

In a nascent and highly speculative market like crypto, future potential often carries more weight than present-day utility. A compelling story about changing the world, whether it’s banking the unbanked or building a decentralized internet, can attract immense capital long before the technology is fully realized.

Why Narratives Can Matter More Than Tech (Sometimes)

In a perfectly rational market, the best technology would always win. But markets are driven by people, and people are driven by stories. A project with slightly inferior technology but a simpler, more powerful, and easily communicable narrative can often outperform its technically superior competitors, at least in the short to medium term.

Understanding crypto narratives is about recognizing that capital flows towards compelling stories.

A Deeper Look: The Lifecycle of a Crypto Narrative

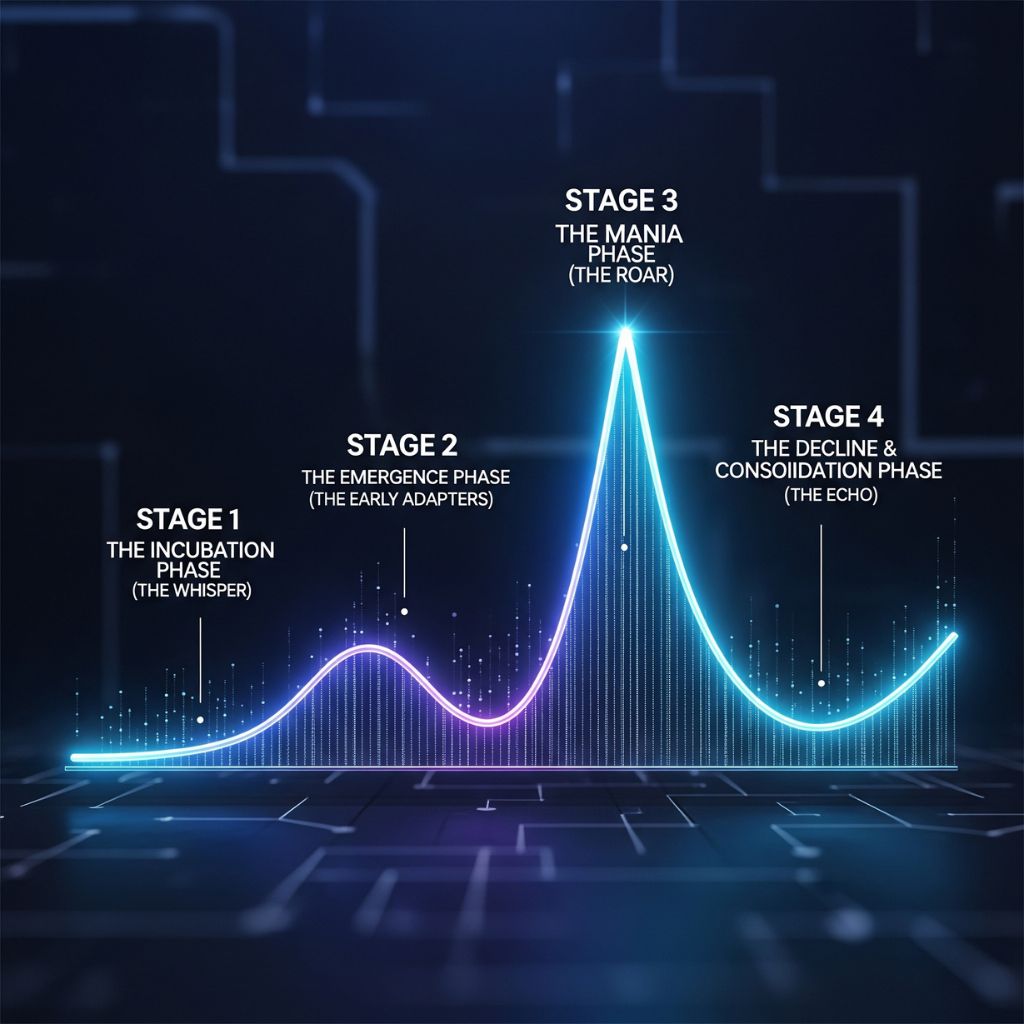

Crypto narratives aren’t static; they are living things that evolve. Recognizing which stage a narrative is in can be the difference between being early and being someone else’s exit liquidity.

Here is a simplified four-stage model:

- The Incubation Phase (The Whisper): This is where it all begins. A new idea emerges on niche forums, developer chats, or Crypto Twitter/X threads. It’s discussed by a small group of builders and deep-domain experts. The language is technical, and the concept is unproven. The risk is highest here, but so is the potential reward.

- The Emergence Phase (The Early Adopters): The narrative starts to gain traction. Influential figures, venture capitalists, and research firms like Scentia Research Group begin to publish reports and analyses. The story gets refined and simplified. Early-adopter investors take notice, and on-chain metrics begin to tick up.

- The Mania Phase (The Roar): The narrative goes mainstream. It’s featured in major news outlets, becomes a trending topic on social media, and your friends who don’t follow crypto start asking you about it. Prices go parabolic as FOMO (Fear Of Missing Out) kicks in. This is the point of maximum opportunity but also maximum risk, as valuations become detached from reality.

- The Decline & Consolidation Phase (The Echo): The hype fades. Capital rotates to the next “new thing.” Prices correct sharply, and many projects within the narrative fail. However, the truly innovative projects with real utility often survive, consolidating and building the foundation for future, sustainable growth.

A Look Back: Major Crypto Narratives That Shaped the Market

To make this tangible, let’s look at some of the most powerful narratives from crypto’s history.

The “Digital Gold” Narrative (Bitcoin)

This is one of the oldest and most enduring narratives. The story is simple: in a world of endless money printing and inflation, Bitcoin (BTC) is a provably scarce, sovereign store of value. It’s a hedge against economic uncertainty, just like gold. This powerful story is what attracts institutional investors and sovereign wealth funds. [internal link: Read our deep dive on Bitcoin’s role in a modern portfolio]

The “World Computer” & “Smart Contracts” Narrative (Ethereum)

Ethereum introduced the idea that a blockchain could do more than just transfer value. It could execute code via “smart contracts.” This birthed the narrative of a decentralized “world computer” that could host unstoppable applications. Every narrative that followed—DeFi, NFTs, GameFi—was built on top of this foundational story.

The “DeFi Summer” Narrative (2020)

The story here was “be your own bank.” Decentralized Finance (DeFi) protocols promised to rebuild the entire financial system—lending, borrowing, trading—without intermediaries. Concepts like “yield farming” and “liquidity mining” captured the market’s imagination, leading to an explosion in value for tokens like $AAVE and $COMP. [external link: The original DeFi Pulse index showing the 2020 growth]

The “NFT & Metaverse” Narrative (2021)

This narrative shifted the focus from finance to culture. The story was about verifiable digital ownership of art, collectibles, and virtual land. Projects like CryptoPunks and Bored Ape Yacht Club became cultural status symbols, and the idea of a persistent, user-owned “Metaverse” fueled massive investment into projects like $SAND and $MANA.

How to Spot and Analyze Emerging Crypto Narratives

Understanding crypto narratives is a skill. It requires synthesizing information from multiple sources. Here’s a professional framework to get you started.

1. Follow the Capital

Money moves first. Pay close attention to where top-tier Venture Capital (VC) firms like Andreessen Horowitz (a16z), Paradigm, and Pantera Capital are investing. Their theses often signal which sectors and stories they believe will dominate the next cycle.

2. Monitor Developer Activity

A narrative needs builders to become a reality. Track developer activity on platforms like GitHub. A surge in developers working on projects within a specific category (e.g., Decentralized Physical Infrastructure Networks – DePIN, or AI x Crypto) is a strong leading indicator.

3. Listen to the Social Graph

Platforms like X (formerly Twitter) and Farcaster are the town squares of crypto.

- Identify Signal: Follow respected developers, researchers, and fund managers, not just price-focused influencers.

- Track Concepts: Use tools to track the frequency of new keywords and concepts. When a niche term starts appearing more often, dig deeper.

4. Validate with On-Chain Data

A story is just a story until data backs it up. On-chain analysis provides the ground truth.

- Are active wallet addresses in the sector growing?

- Is the Total Value Locked (TVL) increasing?

- Are transaction volumes rising?

Answering these questions helps separate fleeting hype from a sustainable trend.

The Pitfalls: How to Avoid Getting Trapped by Hype

While powerful, narratives are also dangerous. The mania phase creates a gravitational pull that is hard to resist, and many investors get burned.

- Distinguish Signal from Noise: During a mania, it’s hard to tell who is a genuine expert and who is just repeating popular talking points. Always ask “why” and return to the data.

- Understand You Might Be Exit Liquidity: If you are first hearing about a narrative on mainstream news, you are likely late. The goal of early investors is to sell their holdings at a profit to later investors. Be brutally honest about your position in the cycle.

- Know When a Narrative is Fading: When the story stops making sense, the social buzz quiets down, and capital begins visibly rotating elsewhere, don’t be afraid to take profits or cut losses. Loyalty to a dying narrative is a recipe for disaster.

Scentia Research Group: Your Navigator in the Narrative Economy

As you can see, effectively understanding crypto narratives is a full-time job. It requires cutting-edge data tools, deep industry connections, and a team of dedicated analysts to filter the signal from the deafening noise.

This is precisely where Scentia Research Group provides an unparalleled edge.

We don’t just follow narratives; we anticipate them. Our institutional-grade research combines quantitative on-chain data analysis with qualitative insights from the builders and VCs who are creating these narratives in the first place. We provide our clients with clear, actionable reports that identify emerging trends during the Incubation and Emergence phases—before they hit the mainstream.

Instead of spending hundreds of hours trying to piece together the puzzle from countless sources, you get the finished intelligence delivered directly to you, saving you time and helping you navigate the market with confidence. Learn more about our research methodology

Conclusion: The Story is the Alpha

In the world of crypto, the best technology doesn’t always win, but the most powerful story almost always gets its moment in the sun. Narratives are the engine of market cycles. They consolidate belief, direct capital flows, and create periods of explosive growth.

By learning to identify, analyze, and act on these narratives, you move from being a reactive investor to a proactive one. You stop chasing prices and start anticipating the fundamental shifts that drive them. Understanding crypto narratives is no longer just an edge; in this market, it is essential for survival and success.

Ready to gain the clarity you need to navigate the next crypto cycle?